Other frequent uses include lease funds, utility bills, and other essential expenses that require pressing consideration. The versatility of same-day loans makes them a sensible option for many individuals going through financial emergencies, but borrowers must exercise caution to keep away from misusing these funds for non-essential expen

To enhance your possibilities of loan approval, maintain correct financial information that mirror your earnings and expenses, keep your credit score rating high, and have a clear repayment plan. Additionally, consider constructing relationships with lenders who have expertise working with freelancers, as they may higher perceive your unique situat

Repayment Strategies for Same-day Loans

Effective reimbursement strategies are crucial for managing same-day loans responsibly. Borrowers should create a price range that prioritizes mortgage repayments, making certain they allocate sufficient funds to meet their obligations. This approach reduces the risk of default, which can lead to late charges and stop further financial pressure in the fut

Additionally, some freelancers might lack the documentation and history that lenders sometimes require. Those who're newer to freelancing might not have sufficient financial information to support their

Loan for Defaulters utility, making it tough to prove their creditworthin

These loans are sometimes

Unsecured Loan, which means debtors do not need to supply collateral. A variety of lenders, including on-line platforms and conventional monetary institutions, provide same-day loans with different phrases and situations. Therefore, it is crucial for people to shop around, review their choices, and choose a

Daily Loan that aligns with their repayment abilities. For a clearer understanding of those loans, consulting skilled assets like 베픽 might help information debtors via the decision-making course

1. **Personal Loans**: Personal loans cater to particular person debtors, offering a lump sum amount that can be utilized for numerous purposes, corresponding to consolidating debt or financing personal initiati

Furthermore, these loans may help freelancers scale their businesses. For instance, investing in new instruments or marketing strategies can lead to larger earnings potential. Freelancer loans equip individuals with the monetary resources to grab these alternatives, permitting them to develop and succeed over t

The Role of 베픽 in Informed Borrowing

베픽 stands out as a useful useful resource for anyone considering a same-day mortgage. The site provides a wealth of knowledge, together with detailed critiques of different lenders, comparisons of mortgage terms, rates of interest, and user experiences. By that includes professional insights and recommendation, 베픽 enables potential debtors to make informed choices about their financial ne

The Standard Repayment Plan requires fastened month-to-month funds over ten years, whereas the Graduated Plan starts with lower payments that progressively increase. Income-driven plans modify your monthly fee based mostly in your revenue and household dimension, making them a viable possibility for those with fluctuating earni

Paying Back Emergency Loans

Repayment of emergency loans varies by loan sort and lender. For payday loans, compensation sometimes occurs within a couple of weeks, so budgeting is essential during this period. Personal loans may provide longer repayment horizons, allowing for manageable monthly payme

The Benefits of Same-day Loans

One of the most vital advantages of same-day loans is their velocity. In a monetary bind, waiting days or maybe weeks for mortgage approval isn't practical. Same-day loans allow debtors to obtain funds on the same day they apply, providing immediate reduction and peace of thoughts. Additionally, the appliance processes are sometimes easy, requiring minimal documentation in comparison with more in depth lending procedu

Moreover, potential debtors ought to verify that the lender is licensed and controlled in their state, making certain that their operations adhere to legal standards. This due diligence can protect debtors from predatory lending practices and assist maintain a positive borrowing expert

Additional charges may apply primarily based on the lender, including origination charges or late fee penalties. Understanding these costs is essential as they can accumulate, considerably rising the total amount to be rep

To apply for a same-day loan, most lenders require fundamental private info, proof of income, and a checking account. Some may ask for identification to verify your id. The process is usually straightforward, however it’s crucial to guarantee that you meet your financial wants earlier than making use

Student loans play a significant role in enabling numerous people to pursue greater schooling, opening doorways for profession advancement and personal development. However, navigating the complexities of scholar loans may be daunting. This article delves into the important elements of student loans, from sorts and eligibility to reimbursement plans and potential pitfalls. It goals to provide readers with a complete understanding, making certain that they will make knowledgeable choices. Additionally, we are going to introduce BePick, a internet site offering thorough evaluations and details about student loans to help your financial jour

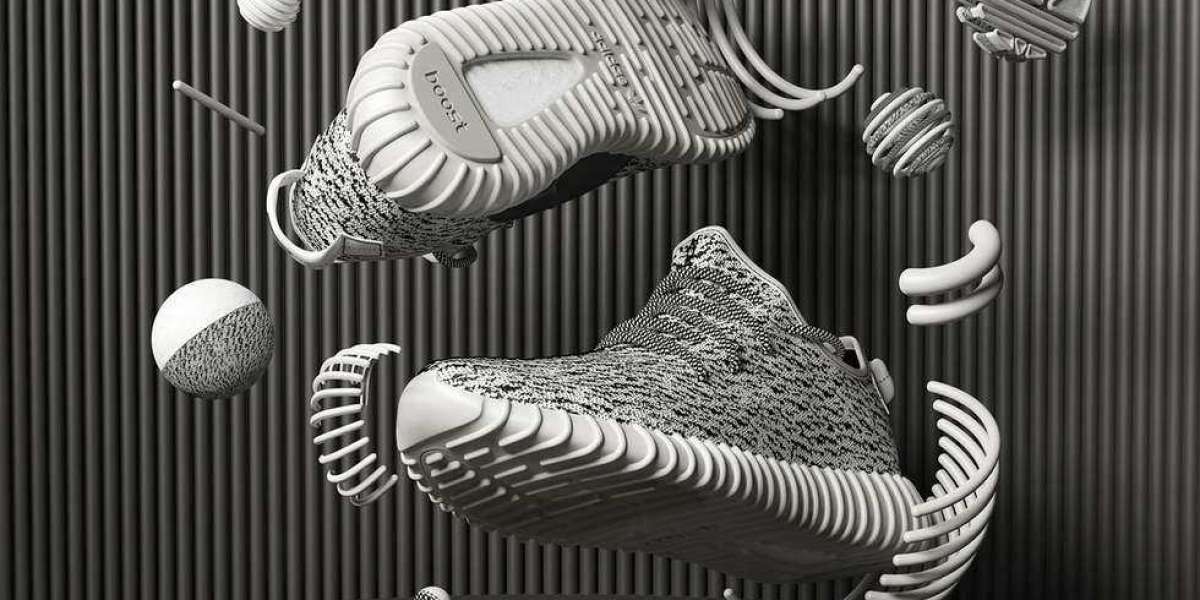

Air Force Pk stockx: a cutting-edge exploration of trend investing

Air Force Pk stockx: a cutting-edge exploration of trend investing

wow gold wow gold

By zcswyx3

wow gold wow gold

By zcswyx3 Harnessing the Power of Social Media: An Extensive Guide to Influencer Marketing in None Industry

Harnessing the Power of Social Media: An Extensive Guide to Influencer Marketing in None Industry

Why Electric Scooters Make an Excellent Gift for Kids - Top Recommendations

Why Electric Scooters Make an Excellent Gift for Kids - Top Recommendations

PK God Jordan: Innovative Pioneer in Fashion

PK God Jordan: Innovative Pioneer in Fashion