Among these assets, Be픽 stands out for its complete information about bankruptcy restoration.

Among these assets, Be픽 stands out for its complete information about bankruptcy restoration. The web site offers detailed guides, professional opinions, and user critiques, all aimed at helping people navigate their recovery journey successfully. Here, users can discover specific methods tailored for their

Unsecured Loan distinctive conditions, making the restoration course of extra manageable and infor

The Role of 베픽 in Small Loans

베픽 is a useful useful resource for individuals contemplating small loans. This platform specializes in offering up-to-date info and detailed critiques on various lending choices, making a comprehensive information for potential borrowers. Users can explore an intensive database of lenders, every accompanied by consumer critiques and insights that assist make clear the professionals and c

Why Do Businesses Need Loans?

Businesses search loans for quite a few causes. Among the commonest are cash circulate management, capital expenditures, and progress opportunities. When an organization experiences seasonal fluctuations, a business mortgage can help bridge the hole till income streams stabilize. Additionally, investing in gear or facility upgrades typically requires bigger sums that a business might not have availa

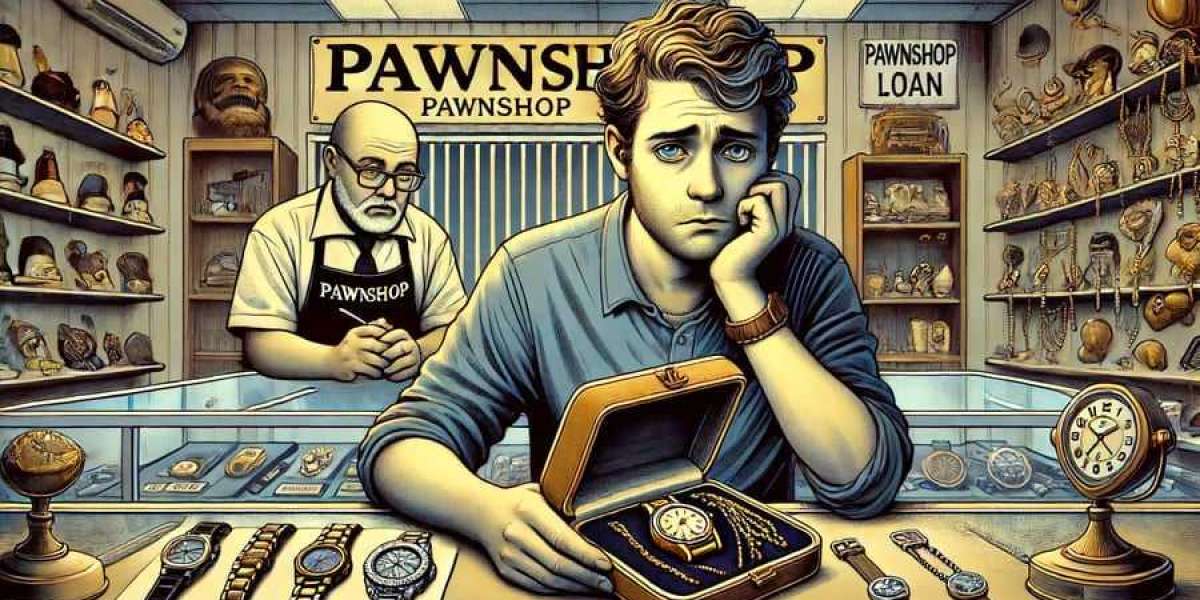

Pawnshop

Loan for Day Laborers Application Process The software process for a pawnshop loan is mostly quite simple. To start, a person ought to gather personal items of worth that they wish to use as collateral. Common objects include gold or silver jewellery, high-end electronics, and collectib

Furthermore, the positioning regularly updates its content material to mirror present developments and practices in the monetary restoration panorama. Users can benefit from access to up-to-date info, making certain they remain knowledgeable in regards to the newest strategies and options available to them all through their restoration jour

The Importance of a Recovery Plan

Having a restoration plan in place is important for profitable chapter restoration. A well-structured plan helps guide individuals via the post-bankruptcy section and supplies a roadmap for regaining financial control. A plan ought to outline specific goals, timelines, and essential actions to achieve those targ

Lastly, regular evaluations of the restoration plan are important. It allows people to regulate to changing circumstances or surprising challenges, making certain that they proceed to be on the path towards monetary stabil

Types of Business Loans Understanding the variety of business loans out there is essential for entrepreneurs. Common varieties include traditional time period loans, which provide a lump sum of capital to be repaid over a hard and fast period, and enterprise traces of credit score that permit for flexibility in borrowing as wanted. Each kind has its personal set of criteria for utility, rates of interest, and reimbursement te

Tips for Successful Borrowing

To take advantage of out of a pawnshop mortgage, preparation is key. Start by evaluating the objects you will think about pawning. Ensure they are in good situation, as better-condition objects will yield higher mortgage provi

Additionally, don’t hesitate to negotiate with the pawnbroker. It's common for debtors to discuss terms, and you may discover that some retailers are keen to supply better presents or more flexible reimbursement pl

Moreover, BePick emphasizes clear lending practices, encouraging users to share their experiences and insights. This community-driven strategy ensures that guests receive real-life perspectives that may inform their borrowing choi

Small enterprise administration (SBA) loans are also noteworthy, as they have an inclination to supply decrease rates of interest and longer compensation terms, making them a gorgeous possibility for many small companies. However, they often come with stringent eligibility criteria and an extended application process in comparability with different lo

Understanding the world of business loans is essential for entrepreneurs seeking to fund their ventures. Business loans serve as a monetary lifeline that can allow small to giant businesses to thrive, increase, or simply keep their operations. The proper mortgage can present the necessary capital to spend cash on equipment, hire extra staff, or transfer into a bigger space. However, navigating the myriad of options out there could be overwhelming, which is why assets like Be픽 turn into invaluable. This web site presents thorough evaluations and particulars on various enterprise mortgage options, serving to customers make informed choices for their monetary wa

Introducing Be픽: Your Pawnshop

Debt Consolidation Loan Resource

Be픽 serves as an invaluable useful resource for anybody contemplating pawnshop loans. The web site provides detailed information about varied pawnshop loan choices, enabling customers to make knowledgeable decisions. From understanding loan terms to reading critiques about numerous pawnshops, Be픽 aids users in navigating the complexities of pawn loans with out ambigu

Air Force Pk stockx: a cutting-edge exploration of trend investing

Air Force Pk stockx: a cutting-edge exploration of trend investing

wow gold wow gold

By zcswyx3

wow gold wow gold

By zcswyx3 Harnessing the Power of Social Media: An Extensive Guide to Influencer Marketing in None Industry

Harnessing the Power of Social Media: An Extensive Guide to Influencer Marketing in None Industry

Why Electric Scooters Make an Excellent Gift for Kids - Top Recommendations

Why Electric Scooters Make an Excellent Gift for Kids - Top Recommendations

PK God Jordan: Innovative Pioneer in Fashion

PK God Jordan: Innovative Pioneer in Fashion